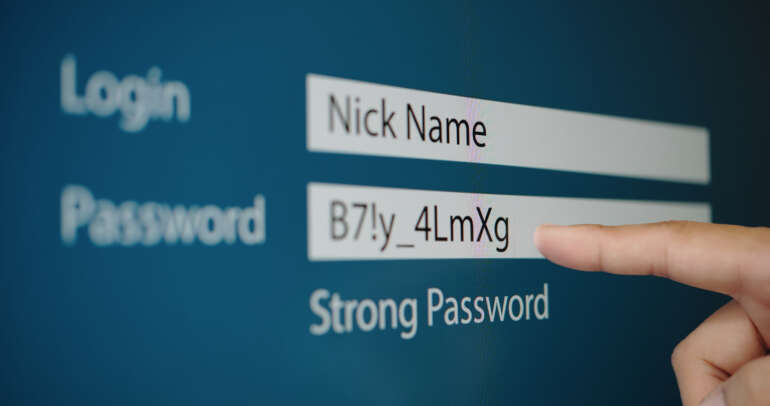

When planning your estate, providing your trustee with essential passwords and information about your assets can save your loved ones significant time, stress, and legal hurdles (expense!) in creating a seamless trust administration after you become incapacitated or pass away. Proper preparation ensures your estate is managed smoothly and according to your wishes. Below are the top 10 types of…