Medi-cal Planning

Helping You With Effective Medi-Cal Planning Strategies

For some clients, estate planning will also include Medi-Cal eligibility planning for nursing home care. Our goal at Absolute Trust Counsel is to plan so that seniors remain independent for as long as possible, while protecting their assets against the expense of nursing home care. We offer compassionate guidance and sound legal counsel whether you are planning well in advance or your family is in a Medi-Cal crisis situation.

What should I expect to pay for long-term care?

The numbers are startling: one out of every two women and one out of every four men find themselves in a nursing home at some point in their lives; nursing home care averages between $6,150 and $14,550 a month in California; and two out of three families run out of money within one year of a prolonged nursing home stay.

What can I do to make sure my family is able to pay for long-term care?

Fortunately, there are options to preserve your life savings. When faced with the prospect of expensive long-term care, we can help you qualify for assistance from Medi-Cal. We can put a number of powerful legal tools to work on your behalf to prepare in advance for a nursing home stay, or help you in a Medi-Cal crisis situation.

Can I plan for long-term care before I need it?

Medi-Cal pre-planning, also known as non-crisis Medi-Cal planning, is for people who are currently healthy but want to make sure that if they become incapacitated, they will be able to protect their life savings. We can design a plan that allows you to preserve your assets and adequately manage your personal and financial affairs in the event of incapacity. With a well-designed and properly implemented plan in place, you not only ensure that you will be well cared for if you become incapacitated, but enjoy greater peace of mind as well.

What if I’m told I have too many assets to qualify?

A Medi-Cal crisis is a situation in which an individual has already been admitted to a nursing home—or must be placed in one very soon—and has been informed that he or she has too many assets to qualify for Medi-Cal assistance.

Don’t panic, the laws governing Medi-Cal eligibility are complicated and ever-changing. Few people fully understand them as the team at Absolute Trust Counsel does, and we can help. Contact our office as soon as possible so that we can show you how to obtain assistance from Medi-Cal.

Am I eligible for assistance from Medi-Cal to pay for nursing home care?

Eligibility requires both medical need and financial need.

The medical need requirement is met once a physician finds that you require nursing home level of care

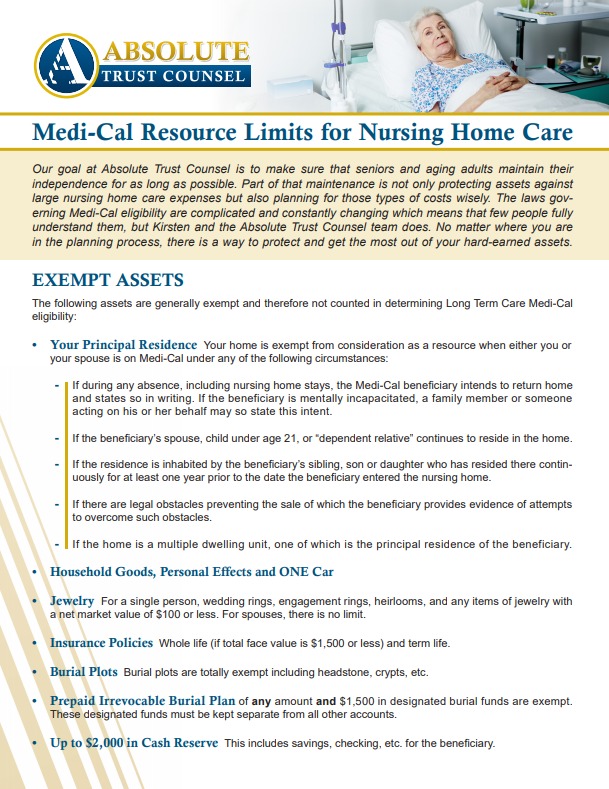

Financial need is established when both income and assets fall below certain limits. To be eligible, your monthly income must be below the monthly cost of the nursing home. In addition, the assets you may own are generally limited to: your personal residence, one car, furniture, clothing and other household items, and $2,000 in other property ($120,900 for a married person).

Reference Guide 3

Medi-Cal Resource Limits Handout

Do You Think You Have Too Many Assets to be Eligible for Medi-Cal? We Can Help. Download Our Free Tool to See Exactly How Your Assets Factor In.