One of the noteworthy pieces of legislation passed in 2024 was Assembly Bill 2016 (AB 2016), which aims to address accessibility, efficiency, and fairness within California’s probate procedures. Probate is the court process through which a deceased person’s assets are administered and distributed to beneficiaries and heirs. It can be a complex, time-consuming, and expensive process. AB 2016 seeks to…

Transfer on Death (TOD) deeds gained legal recognition in 2016 as a means of transferring real property outside of probate in California. Since then, TOD deeds have emerged as a popular estate planning tool, offering a streamlined alternative to probate for transferring real estate assets. A TOD deed is a legal document that allows real property owners to designate beneficiaries…

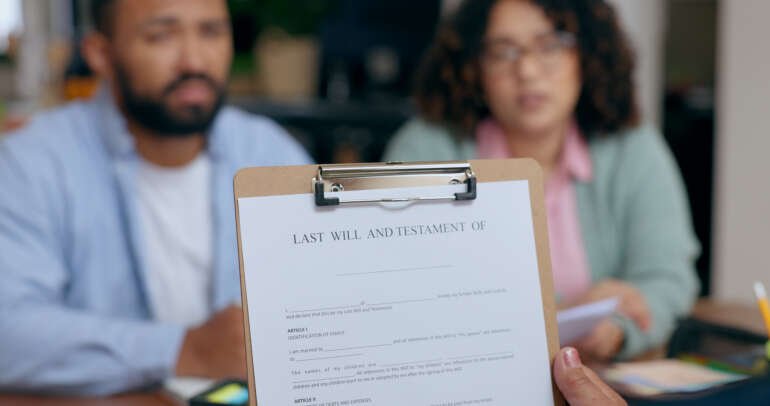

In the realm of estate planning, a will without a trust stands as an important document, orchestrating the distribution of assets and the fulfillment of wishes after one’s passing. In California, the statutory will serve as a convenient template for many individuals seeking to outline their testamentary intentions. While there are times when a statutory will may be sufficient –…