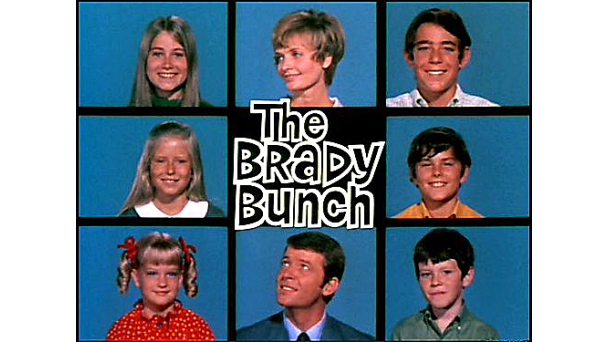

When Miranda Jones married Scott Ludlum, with their six children in total, they anticipated a Brady Bunch existence. For many years, they co-existed peacefully, then Scott became seriously ill. It seems upon marriage to Miranda, Scott had failed to update his Living Will, Financial and Healthcare Powers of Attorney, and HIPAA Release. In all of those documents, Scott had appointed his former wife, Lenore, to make healthcare and financial decisions should Scott be rendered incapacitated.

Scott was incapable of changing those directives. And since he had not altered those documents during his 10 years of marriage to Miranda, the court ruled that the appointments could stand.

In short order, Lenore:

- Barred Miranda and her children from Scott’s hospital room. Because Miranda was not named in Scott’s HIPAA release, she was not allowed to consult with doctors regarding his condition or care.

- Contradicted Scott’s wish–expressed to Miranda–that he not be resuscitated if he slipped into a vegetative state. That decision resulted in almost six months on life support in a long-term care facility, amassing a medical debt in excess of $1 million, seriously depleting the value of Scott’s estate.

- Refused to release the necessary funds to pay the mortgage on the home co-owned by Scott and Miranda–but paid for by Scott–and authorized payment of expenses and tuition only for the children she shared with Scott, forcing Miranda’s children and two children born of the marriage to enroll in public schools.

- Refused Miranda access to checking and savings accounts that had remained in Scott’s name, even though Miranda had contributed to and actively used those accounts.

- Removed Scott’s children from their family home, forbidding any contact with Miranda, her children, or their half-siblings.

- Ordered Scott’s cremation and interment of his ashes in her family plot.

When the dust settled, Miranda was able to produce Scott’s will, which named her as his executor and trustee. Though Lenore contested the will, Miranda prevailed and was able to transfer all of Scott’s remaining assets into trusts for all of his children, as well as a trust that provided for her lifetime support and the support of her children. However, because Lenore had diminished the value of the estate, Miranda was forced to return to work.

Blending a family is no longer a matter of combining two households and hoping for the best. When former marriages and children born of those marriages are involved, all sorts of legal issues can crop up.

To protect all members of a blended family, several things must happen prior to or immediately after marriage:

- Documents related to any prior divorces, such as property settlements and/or custody agreements must be reviewed to determine how they may be impacted by a subsequent marriage.

- Estate planning documents must be reviewed and altered to reflect the change in circumstances. For example, a will, life insurance policies, and financial accounts may name a former spouse as a beneficiary and/executor. In addition, a Living Will, powers of attorneys, and related documents may appoint a former spouse to make financial and healthcare decisions. Those designations remain valid, despite a divorce, unless changed.

- A prenuptial agreement and/or other legal arrangements must be in place to delineate what will remain separate property and what will become marital/community property, as well as clarify the inheritance rights to property brought to the marriage or purchased during the marriage. Issues such as community property, expenses related to the maintenance of separate or premarital property, the inheritance rights of lineal descendants, ownership and use of the family home upon the death of a spouse, and support and custody of minor children from a prior marriage upon the death of a spouse must all be addressed.

Among the most common errors blended families make:

- Thinking members of the blended family will treat each other fairly. Poorly planned estates can divide rather than keep blended families together. When step-parents and step-siblings, and half-siblings come into play, declarations of priority and entitlement are bound to throw a wrench in the settlement of an estate. Only preplanning and clear delineation of who is entitled to what will suffice.

- Failing to change ownership and beneficiary designations on financial accounts, IRAs, pension plans, and life insurance. Rarely do former spouses graciously turn over the proceeds from retirement accounts or life insurance policies merely because their former spouse failed to change the designations in favor of the new spouse.

- Failing to carefully assess trustee designations. Once families are blended, it may be tempting to name the new spouse or a step-child as the executor of a will or trustee of a trust, but it is difficult to guarantee how family politics may intervene. For example, will the spouse favor children born of the marriage over children born of a prior marriage? Will a step-child be motivated to act in the best interests of all children? With blended families, it may be important to select an independent third-party administrator to ensure everyone is treated as the testator/grantor intended.

- Failing to regularly update estate planning documents to reflect changes in financial circumstances, family composition, and related legal/tax issues. Say, for example, that one spouse brings the assets of a deceased spouse to a blended marriage. Should only the children of that deceased spouse inherit those assets, or should they be included in the testator’s overall estate. In addition, are there assets to which a spouse should be granted lifetime use, but upon death pass only to blood descendants?

Remarriage is no longer a matter of showing up before a judge and saying “I do.” When children are involved, it is essential that steps be taken to protect everyone in the blended family.