Perhaps the most important decision you will ever make is who will serve as guardian(s) for your children. In California, a child under the age of 18 is not legally qualified to care for her or himself if both parents die. Any child under the age of 18 must have a legally appointed guardian. Typically, guardians of minor children are…

Jenna and Mark Livingston were living the life of Reilly. At age 30, they had thriving careers—Jenna as an attorney, Mark as a pediatrician—and three children, aged five months, two, and four. Together, they lived in a four-bedroom home in an exclusive neighborhood with their dog, Pepper. Five months after the birth of their third child, Mark decided Jenna required…

Mary and Thomas Charleton had five adult children. Unfortunately, not all of them had the means to purchase their own homes. So after each child married, the Charletons offered them a low interest loan to cover the down payment, up to a certain dollar amount. All of the children took advantage of the offer.

By the time Mary died—at age 62–three of the loans had been repaid in full. However, the couple’s daughter, Dory, made a partial repayment. When she got divorced after five years of marriage and was forced to sell that home, Dory decided she should no longer be required to repay the loan. A son, Robert, figured the amount of the loan would just be taken out of his share of his parent’s estate. He was fine with that. He made no effort to repay the loan.

Robert Manning thought long and hard about the appointment of the executor of his will. He could appoint his wife, but there was a chance he might outlive her. And his wife tended to get a bit scattered when under pressure. Robert wasn’t sure if she could withstand the constant harping of relatives he was sure would show up expecting a handout.

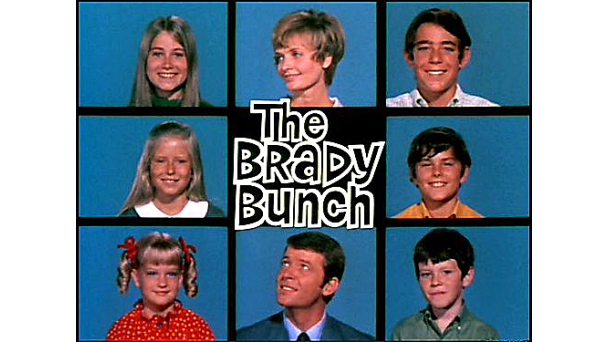

When Miranda Jones married Scott Ludlum, with their six children in total, they anticipated a Brady Bunch existence. For many years, they co-existed peacefully, then Scott became seriously ill. It seems upon marriage to Miranda, Scott had failed to update his Living Will, Financial and Healthcare Powers of Attorney, and HIPAA Release. In all of those documents, Scott had appointed his former wife, Lenore, to make healthcare and financial decisions should Scott be rendered incapacitated.