When we last met Jenna and Mark Livingston, they were hunkered down in St. Thomas, U.S Virgin Islands, waiting for Hurricane Astrid to pass. As they huddled in the town assembly hall, Jenna, an attorney, and Mark, a pediatrician, bemoaned their failure to adequately plan for the care of their children in the event of their death. Both age 30,…

Mary and Thomas Charleton had five adult children. Unfortunately, not all of them had the means to purchase their own homes. So after each child married, the Charletons offered them a low interest loan to cover the down payment, up to a certain dollar amount. All of the children took advantage of the offer.

By the time Mary died—at age 62–three of the loans had been repaid in full. However, the couple’s daughter, Dory, made a partial repayment. When she got divorced after five years of marriage and was forced to sell that home, Dory decided she should no longer be required to repay the loan. A son, Robert, figured the amount of the loan would just be taken out of his share of his parent’s estate. He was fine with that. He made no effort to repay the loan.

Upon the death of their respective husbands, Sara and her daughter, Mary, decided to move in together. Since Sara’s home bore no mortgage, Mary sold her home, and placed the proceeds into a retirement account. They agreed to share living expenses, as well as the cost of maintenance and property taxes on the home. They also agreed that when Sara died, Mary would inherit the home.

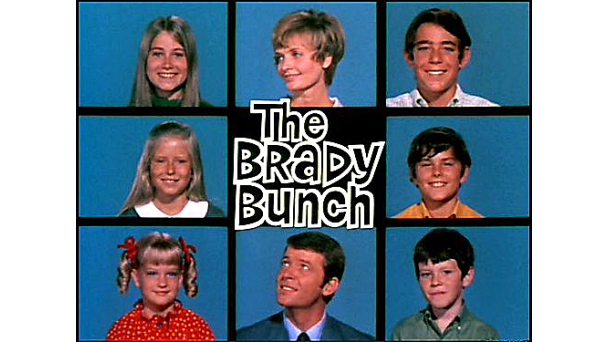

When Miranda Jones married Scott Ludlum, with their six children in total, they anticipated a Brady Bunch existence. For many years, they co-existed peacefully, then Scott became seriously ill. It seems upon marriage to Miranda, Scott had failed to update his Living Will, Financial and Healthcare Powers of Attorney, and HIPAA Release. In all of those documents, Scott had appointed his former wife, Lenore, to make healthcare and financial decisions should Scott be rendered incapacitated.

Preplanning avoids disputes over gifts and loans

After Marilyn Walker’s untimely death, her family solemnly gathered for the reading of her will. According to her attorney, Marilyn divided her estate equally among her four children. Everything seemed cut and dried, until Marilyn’s eldest daughter, Kate, spoke up.

Joint checking accounts are not always the answer.

At age 65, Louisa Willis was anxious to get all of her estate planning ducks in a row. Louisa decided to forgo the traditional methods of estate planning—a Will and Living Trust– and created a joint checking account, naming her son, Ben, as the co-owner. Louisa’s reasoning was simple. By creating a joint account, Ben would have immediate access to her funds “in emergencies,” such as long-term care or upon her death, funeral expenses.

What happens if you die without an estate plan?

If you’re the late rock star Prince, you lose half of your estate to state and federal estate taxes. It appears the government will be dancing to Prince’s “1999” all the way to the bank.According to news reports, when Prince died in April of 2016, he had no will and no other estate plan in place. As a result, almost $100 million of his estimated $200 million estate could wind up in the hands of the tax man.