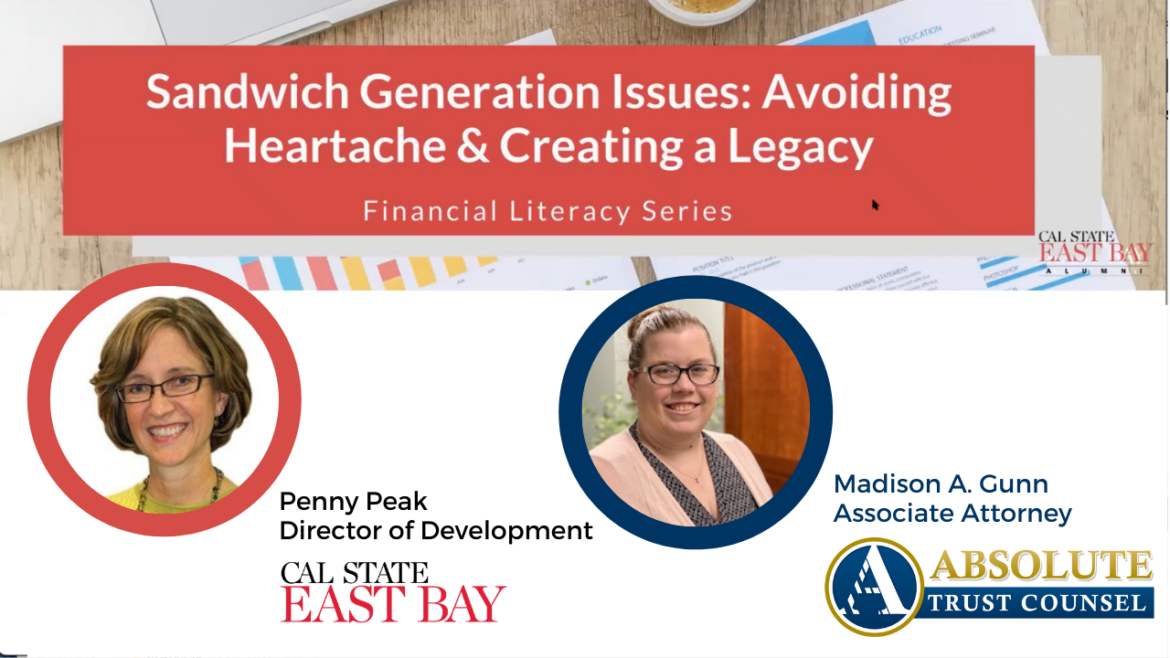

Absolute Trust Counsel Associate Attorney Madison Gunn was recently asked to be a part of Cal State East Bay’s Alumni Financial Literacy Series. This program explores factors that may affect financial and estate planning decision-making, and we’re honored for the opportunity to support Madison and share this presentation with you. The event was hosted by Penny Peak, Development Director at Cal State East Bay, who reached out to Madison as an alumnus of the University. Madison graduated in March of 2014 with a Bachelor of Arts in Liberal Studies and a Minor in Criminal Justice Administration. For this presentation, Madison was asked to develop and present “Sandwich Generation Issues: Avoiding Heartache & Creating a Legacy” to the College of Business and Economics. So, what exactly is the “sandwich generation?” Let’s dive in.

Life often consists of juggling different responsibilities, some old and some new. Finding yourself in a “sandwich generation” means that you are caring for multiple generations of family members, which can be a hefty load to take on. It can bring on feelings of stress and anxiety if you aren’t sure what your next steps are. For example, when creating an estate plan, there’s the responsibility of understanding types of wills, nominating guardians, and being able to distinguish the different types of paperwork that go into providing for your family’s future.

Some things you’ll learn from the webinar include:

- What it means to be part of a “sandwich generation.”

- The importance of having an Estate Plan – where to begin?

- “Lasting legacy” –what does this mean? How can it be maintained?

And more!

No matter what chapter in life you’re in, no matter the number of your dependents or the transitions a loved one may be going through, it’s never too early to plan for the future. This is a presentation you won’t want to miss! So settle in, prop up your feet, and press play.

- The “sandwich generation” are people who care for multiple generations of family members, usually those between an older and younger generation.

- An Estate Plan protects your assets and personal property, which is vital for not only your future but your family’s as well.

- It can be more challenging for a senior (aka a parent) to get their estate together so that they may depend on you for help. It’s important to know where to go for the resources you’ll need.

Time-stamped Webinar:

5:56 Listen in as Penny welcomes Madison and talks more about her expertise and background. Teaser: If you didn’t know, Madison is a part of three professional organizations, the local chapter of the National Aging in Place Council, the Tri-Valley Estate Planning Council, and is a member of the East Bay Trust and Estate Lawyers.

7:43 What exactly is a “sandwich generation,” and how do you know if you’re part of one? Tune in to find out!

8:58 Madison touches on what an estate plan is and the importance of planning out the future, whether it’s for you, an older loved one, or a child. It’s never too early to start.

10:10 In California, this is what a comprehensive estate plan looks like.

10:37 Did you know that a foundational part of an estate plan is a trust? Start listening now for what you need to know about this crucial part of legacy planning and how it protects your assets.

15:42 Our goal with an estate plan is to avoid probate at all costs. It can be a very long and expensive process for your family. But what exactly does that process look like? Let’s discuss.

17:20 What happens if I have a will but no trust in place

18:35 How does someone know if they need an estate plan? Tune in to find out what Madison has to say.

20:10 A vital part of estate planning is determining how older adults will pay for care if needed. Start listening now for the four main ways to pay.

25:19 What should those in the “sandwich generation” consider when developing or updating their estate plans.

29:10 We believe it’s always important to prioritize your future. But now, you may be wondering where to start, and Madison has your back. Tune in for details on what to do next!

31:30 Don’t take on the pressure of planning your future alone, and we don’t recommend you do your estate plan yourself. When it comes to protecting your loved ones and future assets, you’re going to want a professional’s guiding hand to tell you what your next steps are.

35:38 What is the best way to go about making a medical decision when you’re near the end of life?

38:37 If a person dies without a will, when does a survivor start probate?

40:44 If you want to make a relative beneficiary on your bank account, you know, what’s involved?

41:47 Who do you choose if you don’t have an obvious person to become your legal representative?

43:44 If you want to leave your home or another major asset to particular people such as your children, is it enough to have it stated in your will?

45:40 What protection does a spouse have if there is no will?

46:53 In California, what about adult stepchildren? How are they considered in the distribution of assets when there is no will?

49:58 There’s a way of holding property called joint tenancy with the right of survivorship. Is that document is already in place in a trust or a living trust?

51:31 What happens if parents and children live in different states? Where do these documents need to be drafted?

53:48 What about if you have assets in another country?

54:46 What is the amount limit on a pour-over will?

57:48 What happens if a medical decision needs to be made, but a person is incapacitated?

59:05 In what situations would a funeral trust be used, and how do they interface with Medicaid?

1:00:55 What kind of attorney do you consider to be the right kind of attorney to go over all these kinds of planning?

1:01:44 If you’re continuing to collect assets, do you go to the attorney to update the plan each time you accumulate new assets?

1:02:44 How much does it cost to have estate planning done?

Interested in having Madison or Kirsten to speak at your next event? Send us a message through our contact us page and we’ll reach out to you to discuss your special event or feel free to call us at 925.943.2740.

Contact Penny Peak

Penny Peak, MPA ’16

Director of Development, Pioneer Athletics and College of Business and Economics, Empowering Tomorrow-makers

California State University, East Bay

Cell: 510.303-5925 | penny.peak@csueastbay.edu

Resources/Links from the episode:

-

- Download a copy of Madison’s PowerPoint slides here, and follow along!

- Guidebook 1: A Will is Not Enough – Securing Your Legacy with Estate Planning Life can change in an instant. A will is not enough to be prepared. Get free access to our actionable guidebook and start protecting your legacy today. Download Guidebook 1: https://bit.ly/ATCGuidebook

- Guidebook 2: Estate Planning – Beyond the Basics The Essential Guide For Estate Planning Beyond the Basics. Learn how to comfortably define gray areas and assess your own unique needs to effortlessly build a secure future now. Download Guidebook 2: https://bit.ly/ATCGuidebook

- Guidebook 3: An Introduction to Family Trusts Building your estate plan couldn’t be easier. Get our free introductory guide to the number one used estate planning tool, family trusts, and understand exactly how we plan to protect your family. Download Guidebook 3: https://bit.ly/ATCGuidebook

[Ad] Do you need help with your estate planning now? We can help. Together our Absolute Trust Counsel team will take a look at your situation and your specific needs and develop a strategic plan that will protect you and your loved ones, regardless of what may come. Here’s a link to schedule your free discovery today at https://absolutetrustcounsel.com/scheduling/.

If you have any questions or need any help, please feel free to contact us by calling 925.943.2740 or sending an email to info@absolutetrustcounsel.com.

Looking for more information on probate? Visit our probate resource page at https://absolutetrustcounsel.com/practice-areas/probate/ for guidebooks, podcasts, videos, and more!