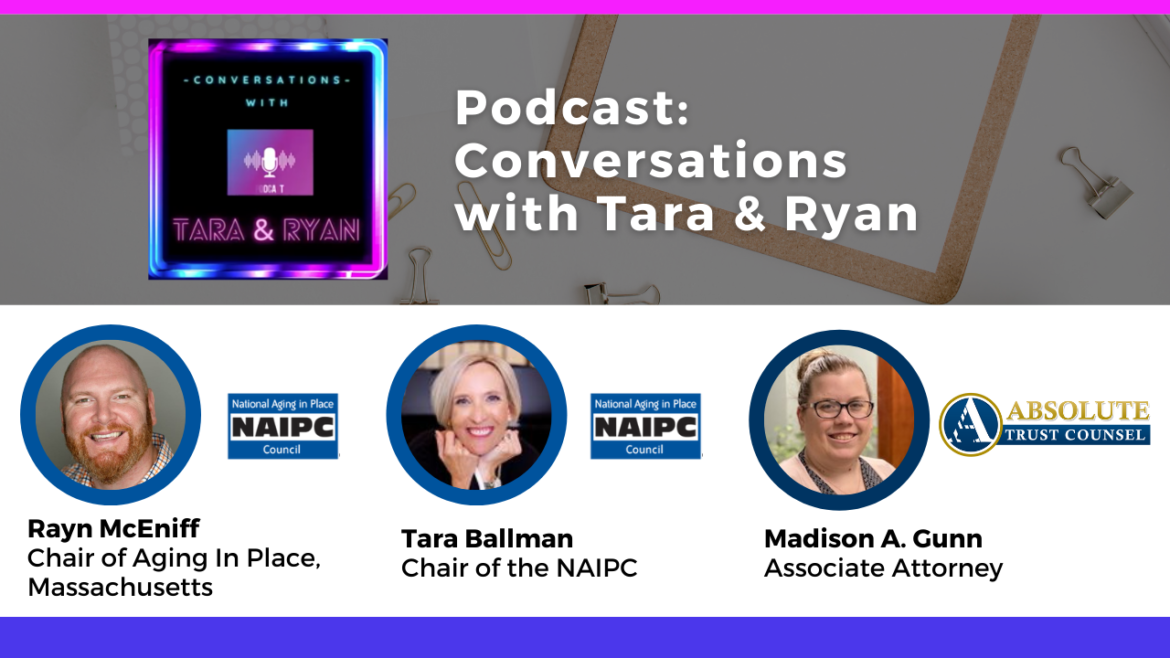

Absolute Trust Counsel Associate Attorney Madison Gunn was recently asked for an interview on the National Aging in Place Council Podcast, Conversations with Tara & Ryan. The National Aging in Place Council is a senior support network that helps older Americans remain as independent as possible while they age in their homes. This podcast supports the organization’s goals and mission as it works to highlight members and partnering experts in the healthcare, financial services, elder law, design, and home remodeling industries. In addition to being an associate attorney here at our firm, Madison is also the Chair for the San Francisco/Bay Area chapter of Aging in Place.

Hosted by Tara Ballman, Chair of the NAIPC, and Ryan McEniff, Chair of Aging in Place, Massachusetts, this episode dives into the world of estate planning. As many of us know, planning for the future can be nerve-wracking, challenging, and even uncomfortable. No one enjoys thinking about life after death, but it’s important to consider when it comes to protecting assets and providing for the family we leave behind. For example, what will become of your children? How about your home? What if you have a pet that you want to ensure is taken care of? There are so many factors to consider, but you don’t have to do it alone.

Some things you’ll learn from the episode include:

- What exactly an estate is and why you don’t have to be wealthy to have one.

- Insights on how to shield your assets from excessive estate taxes.

- Why is planning for the future so important? Why does it all matter?

And more!

No matter what chapter in life you’re in, no matter the number of your dependents or the transitions a loved one may be going through, it’s never too early to plan for the future. With that in mind, we’ll let Madison take it away!

Big Three from the Podcast:

- It isn’t just the wealthy who need wills and trusts. It is something that everyone should consider no matter your income.

- If you pass before having an estate plan in motion, then it could end up taking years for your things to be sorted and dispersed to family members—at least two years (minimum).

- Having a plan in place allows you opportunity to make sure your wishes are known and gives your family a course of action.

Time-stamped Show Notes:

0:10 Introduction

1:52 Did you know? Every single state has its own probate code. So while some legal items are shared across state lines, it’s important to consult with an attorney in your state to ensure you are protected.

2:18 Most people assume that wills or trusts are for the wealthy, but that isn’t true. It’s simply what you own – your assets.

3:01 Having a will or a trust is vital if YOU want to have a say in what happens to your estate once you pass on. Start listening now for more insights.

3:12 Did you know? Most states have a law that disperses your assets after you die if you don’t have a will or a trust set up.

3:43 Often, we think about what will happen to our house after we pass, how the money will be handled, who gets what car, but what about our pets? Who’s going to take care of them?

5:03 Ryan shares a quick anecdote about a client who recently passed away with their loved ones arguing over who gets what in the next room. Bottom line: no matter what your plan is, get one in place, so your family knows your wishes and the best course of action.

5:54 You may be overthinking the process. And if you are, you’re not alone! Estate plans don’t have to be some “big, overcomplicated estate plan.” It’s not a “one size fits all.”

6:20 Listen in as Madison talks about some of the most common things that people fight over regarding estate planning.

7:02 Fast Facts: In California, joint tenancy on a bank account overrides an estate plan, so staying on top of what’s going where is important! Here’s what you need to know.

7:49 Should people be adding their children to bank accounts to? Does it make it easier in the long run or harder?

9:37 Taxes are high in just about every state, so is there a way to shield your assets from being taxed? Madison has the answers. Tune in now to hear what Madison has to say. (Spoiler: California actually doesn’t have estate tax!)

13:39 Ryan asks Madison if there are any other services that she finds a lot of families coming to her for that pertain to planning. Maybe something out of the norm? If you’ve invested in cryptocurrency or a lot of digital assets (i.e., social media), you’re going to want to tune in!

16:12 Speaking of cryptocurrency, did you know it’s designed to be anonymous, meaning you can’t include it in your trust or your will? You can’t even put a beneficiary on the account! It’s important to have those logins and passwords available for your family members to access that money once you’ve passed.

21:20 What happens if you pass and don’t have a will or a trust set up? What happens to all your stuff? Hint: It goes into probate, which can be an extensive process that takes years to settle.

26:00 People who create their will or set up a trust can do more than just allocate money to loved ones or donate their estate to charities–they can make requests. This sounds great, but does it ever create problems, or is counseling needed to help families move forward?

28:09 Madison shares more about what’s being done for the seniors in San Francisco and how the Bay Area chapter is getting involved.

Interested in having Madison or Kirsten to speak at your next event? Send us a message through our contact us page and we’ll reach out to you to discuss your special event or feel free to call us at 925.943.2740.

More About NAIPC, Tara, and Ryan

The National Aging in Place Council® is a senior support network that connects service providers with elderly homeowners, their families, and caretakers.

The San Diego Chapter of NAIPC was founded to create a local source of accurate information and quality resources for seniors wanting to remain in their home. Case studies and educational programs are presented at our monthly meetings to better educate the businesses and agencies serving San Diego County’s seniors on best practices, services, and resources. Our membership includes professional service providers, business owners, government agencies, individuals and non-profit organizations who all support aging in place in San Diego.

Our chapter’s mission is to make aging in place a viable option for all seniors in San Diego through education and advocacy. Our members are dedicated to person-centered care that supports a senior’s choice to remain in their home as they age. Please join us at our monthly meeting if you are interested in learning more.

The San Francisco/Bay Area chapter can be reached by emailing SFBayArea@ageinplace.org

The San Diego chapter can be reached at 858-451-4953. naipc@ageinplace.org

Ryan McEniff, Aging Place, Massachusetts Chair, ryan@mwhomecare.com

[Ad] Do you need help with your estate planning now? We can help. Together our Absolute Trust Counsel team will take a look at your situation and your specific needs and develop a strategic plan that will protect you and your loved ones, regardless of what may come. Here’s a link to schedule your free discovery today at https://absolutetrustcounsel.com/scheduling/.

If you have any questions or need any help, please feel free to contact us by calling 925.943.2740 or sending an email to info@absolutetrustcounsel.com.

Looking for more information on probate? Visit our probate resource page at https://absolutetrustcounsel.com/practice-areas/probate/ for guidebooks, podcasts, videos, and more!