Jenna and Mark Livingston were living the life of Reilly. At age 30, they had thriving careers—Jenna as an attorney, Mark as a pediatrician—and three children, aged five months, two, and four. Together, they lived in a four-bedroom home in an exclusive neighborhood with their dog, Pepper. Five months after the birth of their third child, Mark decided Jenna required…

After years of marital discord, John and Angie Wakefield finally decided to call it quits. John filed for divorce in California on the grounds of irreconcilable differences, asking for a fair and equitable division of community property, retention of all separate property, and shared custody of their two children. In her response, Angie not only requested child support, she sought…

Mary and Thomas Charleton had five adult children. Unfortunately, not all of them had the means to purchase their own homes. So after each child married, the Charletons offered them a low interest loan to cover the down payment, up to a certain dollar amount. All of the children took advantage of the offer.

By the time Mary died—at age 62–three of the loans had been repaid in full. However, the couple’s daughter, Dory, made a partial repayment. When she got divorced after five years of marriage and was forced to sell that home, Dory decided she should no longer be required to repay the loan. A son, Robert, figured the amount of the loan would just be taken out of his share of his parent’s estate. He was fine with that. He made no effort to repay the loan.

Robert Manning thought long and hard about the appointment of the executor of his will. He could appoint his wife, but there was a chance he might outlive her. And his wife tended to get a bit scattered when under pressure. Robert wasn’t sure if she could withstand the constant harping of relatives he was sure would show up expecting a handout.

Upon the death of their respective husbands, Sara and her daughter, Mary, decided to move in together. Since Sara’s home bore no mortgage, Mary sold her home, and placed the proceeds into a retirement account. They agreed to share living expenses, as well as the cost of maintenance and property taxes on the home. They also agreed that when Sara died, Mary would inherit the home.

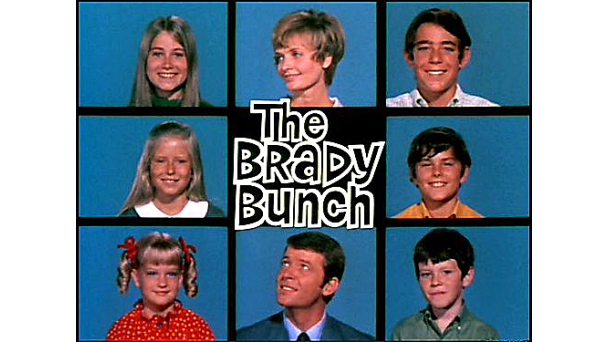

When Miranda Jones married Scott Ludlum, with their six children in total, they anticipated a Brady Bunch existence. For many years, they co-existed peacefully, then Scott became seriously ill. It seems upon marriage to Miranda, Scott had failed to update his Living Will, Financial and Healthcare Powers of Attorney, and HIPAA Release. In all of those documents, Scott had appointed his former wife, Lenore, to make healthcare and financial decisions should Scott be rendered incapacitated.

Do I Need to Update my Estate Plan?

When Jackson Carter died, his family knew just where his estate planning documents were stored: In his safety deposit box. He had told them so at least once a week.

Once the family received permission to open the box and remove the documents, they delivered them to his attorney. Then they met to discuss the particulars.

Sally Janes could not wait to retire.

She and her husband, Ben, had been saving for retirement since their children had completed their college degrees. They decided the “magic number” was age 65, when they would qualify for 90 percent of their Social Security benefits. Combined with their respective retirement plans and savings account, the money from Social Security would permit them to live in comfort for the rest of their lives.

It began on a sunny Saturday morning, when 70-year-old Sandra Johnson’s phone rang.

“Sandra, Sandra Johnson?” the caller asked.

“Yes, that’s me,” she responded.

“I’m pleased to inform you that you have won the Clearinghouse Sweepstakes, a grand prize of $1 million! Unfortunately, when we went to your address to deliver the check, no one was home. Before we go further, could you verify your address for me?”

Chuck Meiers was nestled in his bed when the call came. “Is this Charles Meiers? The owner of the building at Morgan and Main, CM Towers? I believe your business, CM Law, is the sole tenant there?” “Yes?” “Sir, this is the San Valdeos Fire Department. We responded to a fire alarm at your building. There is a lot of black smoke coming out of your roof. It appears your building is on fire.”